Auto insurance plays an important role in protecting drivers from unexpected financial setbacks caused by accidents or other events that damage vehicles or property. If you’ve wondered how it works, why it’s necessary, or how to select the best option, this blog post is for you. We’ll break down the basics, step-by-step, to make auto insurance easy to understand. From coverage options to tips for lowering premiums, we’ve got everything you need to know about vehicle insurance.

What is Auto Insurance?

Auto insurance is a legal agreement, also known as a contract, between you and an insurance company. It’s designed to provide financial protection if you cause an auto accident, damage your auto, or experience other incidents involving your vehicle.

When you buy an auto insurance policy, you pay your premium (a fixed amount) regularly, either monthly or annually. In return, the insurance company agrees to pay for specific types of damage or losses outlined in the policy. Auto insurance coverage generally protects you from the costs of an auto accident, such as property damage, personal injuries, and legal expenses.

Auto insurance is legally required in most states in the U.S., with each state mandating a minimum limit of auto liability insurance that drivers must carry. Personal auto insurance is mandated to ensure that people without insurance don’t leave others with huge financial burdens after an accident.

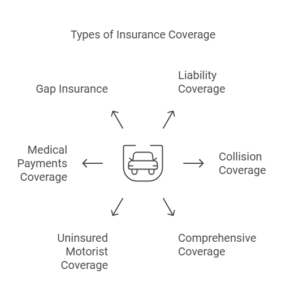

Types of Auto Insurance Coverage

Having enough insurance to cover accidents and emergencies is crucial. The main types of insurance coverage that most people opt for include:

- Liability Coverage – This is the most basic type of insurance required. It covers injuries and damages that you cause to others. It includes:

- Bodily Injury Liability: Protects against costs related to injuries you cause to another person.

- Property Damage Liability: Pays for any damage to someone else’s vehicle or other property you cause.

2. Collision Coverage – Helps pay for damage to your car due to your auto colliding with an object, such as another vehicle or a fence, regardless of who is at fault.

3. Comprehensive Coverage – This covers damage to your auto caused by weather, theft, or vandalism, which are not collision-related.

4. Uninsured & Underinsured Motorist Coverage – This protects you if a driver without insurance hits you or the at-fault driver’s insurance isn’t enough to cover the damages.

5. Medical Payments Coverage – Pays for medical bills, injuries, or even funeral costs for you or your passengers, regardless of fault.

6. Gap Insurance – Ensures you’re covered if your vehicle is totaled and the insurance payout doesn’t cover your car loan’s balance.

Each policy is customizable, allowing you to select your insurance coverage based on your circumstances. A good insurance agent or company can help tailor the right plan for you.

Understanding Coverage

When purchasing a policy, knowing what each type of Coverage pays for and how much protection it offers is essential. Here’s a closer look with real-life examples:

- Liability Insurance protects you if you injure someone in an accident. For example, suppose you accidentally cause an auto collision that results in $10,000 in medical expenses and $8,000 in car repair costs. In that case, your liability insurance will pay for it (up to your policy limit).

- Collision Coverage will pay to repair your vehicle if you rear-end another car, regardless of whether the other driver is at fault.

- Comprehensive Coverage is beneficial for cases such as hail damage or if your car is stolen. If your vehicle is worth $20,000 at the time of theft, comprehensive insurance may reimburse you (minus the deductible).

Remember to review the details in your policy. For example, some auto insurance policies come with a deductible—the amount you pay before the insurance steps in. Choosing a higher deductible often reduces your auto insurance premium.

Factors Affecting Premiums

You’ve probably heard different people mention paying wildly different rates for their car insurance. That’s because several factors influence auto insurance premiums:

- Driving Record – A clean driving record often results in lower rates, while traffic violations or accidents can increase premiums.

- Age – Younger, inexperienced drivers typically pay more due to higher accident risk.

- Vehicle Type – Sports cars, luxury autos, or vehicles with costly repair prices generally come with higher rates.

- Location – Living in areas prone to theft or accidents can raise premiums.

- Policy Details – Additional coverages, low deductibles, and higher coverage limits result in higher costs.

- Credit History – Some auto insurers may consider your credit score when calculating rates.

Tips for Saving on Auto Insurance

If you want to shop for auto insurance and save money, try these practical tips:

- Bundle Policies – Combine home, renters, or other insurance policies with your auto insurer for discounts.

- Drive Safely – Avoid accidents and maintain a good driving record. Many insurers reward safe driving.

- Increase Deductibles – Opt for a higher deductible if you’re confident paying for minor damages.

- Ask About Discounts – Request discounts for features like being a long-time customer, installing safety devices, or taking defensive driving courses.

- Compare Insurance Companies – Always check rates from multiple insurers to assure you get the best deal.

The Claims Process

Filing an insurance claim can feel overwhelming after an accident. Here’s a simple breakdown of the steps to ensure a smooth experience:

- Contact Your Insurance Agent – Provide them with details of the incident, including photos and accounts of what happened.

- Submit Necessary Documents – Share police reports, photos, and repair shop estimates, if applicable.

- Understand Your Policy – Ensure the damage falls under the selected insurance coverages you need before repairs start.

- Wait for Review – Your insurance provider will evaluate the incident after submitting your claim.

- Receive Payment – If approved, the insurance company will pay you according to the terms of your policy.

Remember, depending on your policy, your insurer may not pay for specific events. Always ask your insurance company or agent if you have concerns.

Emerging Trends in Auto Insurance

The auto insurance industry is evolving, and here are a few exciting trends:

- Usage-Based Insurance – This type of Coverage monitors your driving habits (like speed and mileage) through devices or apps, offering premium discounts for responsible drivers.

- Telematics Technology – Advanced safety technology in vehicles, such as anti-theft systems, can lower insurance rates.

- AI and Automation – Many insurers use artificial intelligence to provide faster quotes and streamline claims processes.

How to Get Started with Auto Insurance

Understanding how car insurance works empowers you to make sound decisions for your protection and finances. Whether choosing a higher deductible, bundling insurance products, or consulting an insurance agent, the proper steps will ensure you’re covered when it matters most.

Start today by evaluating your needs and comparing auto insurance policies. If you’re ready to shop for more innovative options, contact reliable auto insurers or get an instant quote online.