Owning a vehicle brings freedom & convenience but also comes with responsibilities. Chief among them is ensuring your car is legally and financially protected. This is where motor insurance steps in. Motor insurance (auto insurance) is a crucial tool that protects you, your vehicle, and others on the road. Understanding motor insurance is essential if you’re a first-time vehicle owner or looking to renew your policy. This guide is here to help you break it all down.

What Is Motor Insurance and Why Is It Essential?

Motor insurance is a contract between you (the policyholder) and an insurance provider. The insurance company agrees to pay for certain losses or damages due to your vehicle, as outlined in your policy. This could include anything from damage to your car caused by an accident to covering the costs for injuries caused to another motorist.

Why Is Motor Insurance Important?

- Legal Requirement: In many countries, motor insurance is a legal requirement. Driving without it can lead to serious consequences, including hefty fines or the suspension of your license.

- Financial Protection: Insurance protects you financially in case of accidents, theft, or harm to your vehicle.

- Peace of Mind: Having enough insurance coverage ensures you’re prepared for unexpected events, be it bodily injuries to third parties or damage to your car.

Put, motor insurance helps you drive stress-free. Now, let’s explore the different types of motor insurance policies.

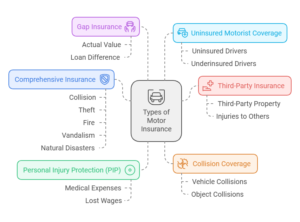

Types of Motor Insurance

Understanding the types of motor vehicle insurance policies available is key to picking the right one for your needs. Here are the common ones broken down for you:

Comprehensive Insurance

Comprehensive insurance is among the most sought-after coverage options, offering extensive and reliable protection. This type of insurance covers damage to your car from various events, including collisions, theft, fire, vandalism, or natural disasters. It typically combines comprehensive and collision coverage features, making it an all-in-one protective package. Comprehensive coverage pays even when the damage isn’t due to a crash.

Third-Party Insurance

Third-party insurance is often the minimum insurance requirement in many places. It covers damages or injuries caused to another vehicle, third-party property, or person. However, this type of insurance won’t cover your car or personal injuries.

Personal Injury Protection (PIP)

PIP, commonly known as no-fault insurance, covers medical expenses & lost wages resulting from an accident, regardless of who was at fault. This is particularly helpful for covering medical payments for you and your passengers.

Collision Coverage

Collision insurance explicitly covers damages to your vehicle that result from a collision with another vehicle, object, or even a rollover. It is often paired with comprehensive coverage for complete protection.

Gap Insurance

If your vehicle is financed or leased and gets totaled in an accident, gap insurance covers the difference between the actual value of the vehicle & what you owe on the loan or lease. For example, if your insurance company pays $15,000 for a car, you still owe $18,000; gap insurance will cover the $3,000 gap.

Uninsured Motorist Coverage

Uninsured motorist coverage reimburses you if an uninsured driver causes an accident. It also covers underinsured motorists or cases where the at-fault driver’s insurance isn’t enough to cover all damages or medical costs.

These are just some of the main options. Additional add-ons like roadside assistance or supplemental insurance products can tailor a policy to meet your needs better.

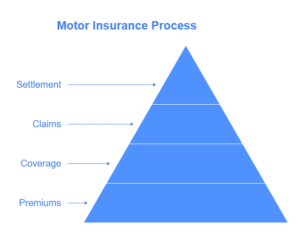

How Motor Insurance Works

Motor insurance works as a partnership between you and an insurance provider, where you pay auto insurance premiums, and the insurer ensures financial protection when certain situations arise. But how does the entire process work?

- Premiums

An insurance premium is the amount you pay an insurance company at regular intervals (monthly or annually). Premium costs are influenced by various factors, such as the scope of your insurance coverage and the type of insurance policy you choose.

2. Coverage

Your insurance policy covers specific situations like accidents, theft, or damages caused by fire. Some policies also provide coverage for personal injury or medical payments. It’s important to remember that your insurance coverage is always specified in the policy details.

3. Claims

You file an insurance claim with your provider when there’s an incident. For example, if your vehicle is damaged in an accident, you’d submit a claim outlining the incident, supported by relevant documentation like photos or police reports.

4. Settlement

The insurance company will process your claim and provide payment if the event is covered under your policy. It will either cover the costs of car repairs, medical bills, or replacement in the case of total loss (depending on the terms of your policy).

Insurance helps ensure you don’t bear the full brunt of financial liabilities from accidents while providing peace of mind as you drive.

Factors Affecting Motor Insurance Premiums

Your premium isn’t a fixed cost—it varies significantly depending on several key factors. Here’s what shapes your auto insurance rates or insurance program costs:

- Type of Vehicle: High-performance and luxury vehicles often come with higher insurance premiums, largely due to the elevated costs of repairs and replacements.

- Driver’s History: A clean driving record with no motor accidents or claims can lower your insurance rate, while a history of accidents or violations may increase it.

- Location: Whether you live in an urban area with heavy traffic or a rural town with fewer road risks influences your premiums. Areas with higher car theft rates also attract higher premium costs.

- Age and Gender: Younger drivers often face higher premiums due to perceived inexperience, while statistical studies might influence rates by gender.

Keep these key factors in mind when choosing auto insurance to find a policy that suits your needs without exceeding your budget.

Tips for Finding the Best Motor Insurance

Getting the ideal motor insurance policy for your needs can be manageable. Follow these tips to stay ahead in finding the best insurance coverage for your motor vehicle:

-

Compare Policies

Use online tools to compare auto insurance policies, premium charges, and benefits. This will give you a clearer idea of what’s available in the market.

-

Read the Fine Print

Carefully read all terms and conditions in the insurance documents. Understand what your policy also provides coverage for and any potential exclusions.

-

Look for Discounts

a lot of insurance companies provide discounts for bundling policies, maintaining a clean driving record, or outfitting your vehicle with specific safety features.

-

Ask for Help

Consult insurance companies or independent brokers who can guide you based on your insurance information requirements.

The Impact of Technology on Motor Insurance

Technological innovations like telematics are revolutionizing how motor insurance works. These insurance companies offer more personalized pricing models based on driving behavior data collected through vehicle telematics devices. Tech adoption makes finding affordable auto policies easier while drastically improving claims processing times.

Crafting Your Coverage

Motor insurance isn’t optional—it’s essential. By understanding the intricacies of auto insurance coverage, you’re equipping yourself with valuable knowledge to drive confidently. Whether you’re selecting liability insurance to meet minimum legal requirements or opting for comprehensive coverage, having enough insurance ensures financial protection and peace of mind.

Action step? Review your current policy or consider getting quotes that match your coverage needs better. Safe driving starts with smart coverage decisions!